Testimonies to the Fairfax County Board of Supervisors on the County Budget - 04/11-13/2023

The Board of Supervisors held its final public hearing on property tax increases on April 11-13. (Local proposals: FxCo $1.11/$100; Arl $1.04; PrWm $0.98; Loudoun $0.89.) Three members of the Fairfax County Taxpayers Alliance made strong protests over the proposed 7% tax gouge:

- Arthur Purves - FCTA president at Tax Rate Hearing

- Arthur Purves - FCTA president at Budget Hearing

- Charles McAndrew - FCTA board member at Budget Hearing

- Tom Cranmer - FCTA board member at Budget Hearing

- Gazette Leader - FCTA in the news ...

- FXX Now - FCTA in the news ...

- Connection - FCTA in the news ...

- Patch - FCTA in the news ...

Testimony from Arthur Purves (Vienna) at Tax Rate Hearing

Members of the Board:

Thank you for the opportunity to testify. I am Arthur Purves and address you as president of the Fairfax County Taxpayers Alliance.

The purpose of this hearing is to solicit community input on your proposed 6-cent increase in the real estate tax rate.

However, only three people have signed up to testify. How could the county be so indifferent to a 6-cent increase in the tax rate? Perhaps it's because they don't know about it.

In his March 7 email about the advertised tax rate, the county chairman stated that the advertised rate of $1.11 is "unchanged from last year". That statement is in violation of the Virginia Code (Section 58.1- 3321), which states that previous year's rate must be lowered to offset the increase in assessments. That lowered rate is $1.05, which you were required by law to publish in a legal announcement that appeared in the March 9, 2023, issue of the Washington Times.

The correct statement in the chairman's newsletter would have been that the $1.11 advertised rate is a "6-cent increase from last year". The chairman did not say that.

The $1.05 "lowered" rate offsets the 5.7% average assessment increase of both commercial and residential properties.

However, the rate that would offset the assessment increase for single-family dwellings is $1.03, since the assessment increase for single-family dwellings (7.80%) was higher than the commercial increase (1.65%).

If you adopt a rate of $1.08, which you seem poised to do, that would be a 5-cent increase for homeowners and would cost them $360 on top of this year's tax increase of $664 (includes the car tax hike). So, you will have raised homeowner taxes $1000 in two years.

You will say, as you did last year, that you "reduced" the tax rate, a statement that violates the Virginia code.

A good rule of thumb for homeowners is that when the supervisors say that they are reducing the tax rate, expect a tax increase. This is because the supervisors only reduce the tax rate when there is an assessment increase, and the rate is never reduced enough to offset the increase.

Is it unreasonable to assume that the low attendance at this hearing is by design?

Not only did the chairman's newsletter misrepresent the $1.11 advertised tax rate as "unchanged", he did not mention this hearing.

In fact, when I went to the Fairfax County News Center and searched for "advertised tax rate", I got "YOUR SEARCH YIELDED NO RESULTS". Shouldn't you at least advertise the advertised tax rate? It is an important number. It is the upper limit on the tax rate the supervisors can adopt when they vote on the budget.

When I searched for "tax rate hearing", I again got "YOUR SEARCH YIELDED NO RESULTS".

This hearing is not mentioned on the county's budget timeline. It's not mentioned anywhere that I can find except for the obscure ad in the legal section of the Washington Times.

I have occasion to visit Utah and took the opportunity to talk to the Utah Taxpayers Association. In 1985 Utah passed a Truth-in-Taxation law. The Utah state code requires local governments, when they advertise a tax rate that will increase real estate taxes, to mail to each homeowner an assessment notice with the advertised rate, the dollar increase that rate would produce in each homeowner's real estate tax bill, and the date of a public hearing to hear testimony on the advertised rate.

The Fairfax County Taxpayers Alliance urges you to do the same and to also add this provision to your legislative agenda for the General Assembly.

You already send out an assessment notice to each homeowner. Just send the notice after the advertised rate is announced, state the resulting increase on their real estate tax bill, and publish the date and time of this hearing.

The Alliance thinks that you should be transparent with the people who pay your salaries.

Thank you.

Testimony from Arthur Purves (Vienna) at Budget Hearing

Members of the Board:

Thank you for the opportunity to testify. I am Arthur Purves and address you as president of the Fairfax County Taxpayers Alliance.

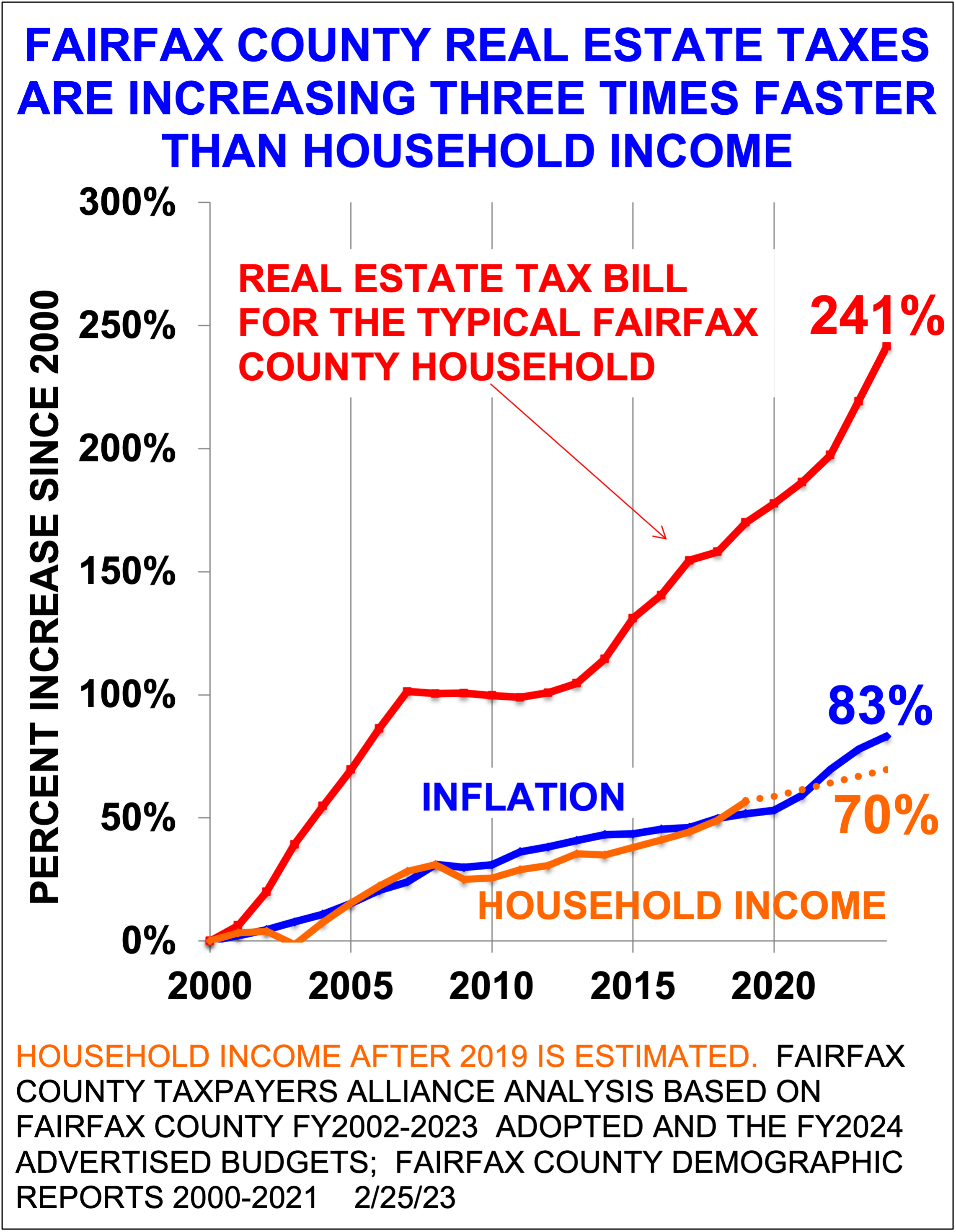

Since FY2000 the supervisors have been raising residential real estate taxes three times faster than household income. The average annual increase in household income is 2.3%, and the average annual increase in household real estate taxes is 5.3%.

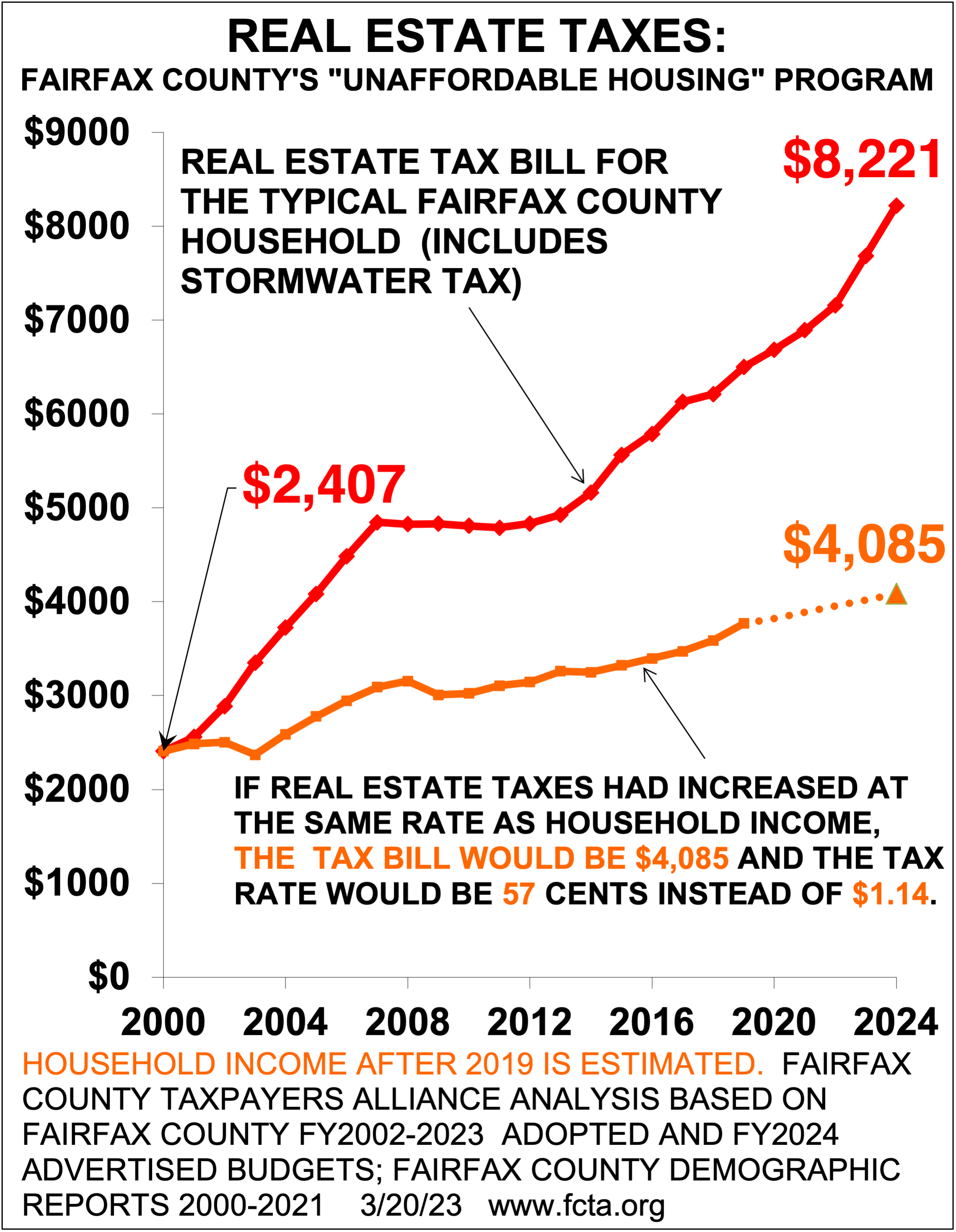

The typical homeowner now pays about $8,000 in real estate taxes. If real estate taxes had increased the same rate as household income, the typical tax would be $4,000, and the rate would be 57 cents instead of $1.11.

Why are taxes increasing faster than incomes? The answer is compensation.

Since FY2000, household income and county and school revenues have barely kept up with inflation. However, county and school spending for compensation increased faster than inflation. Inflation is 83% while compensation increased 141%. To pay for it this board increases real estate taxes faster than income.

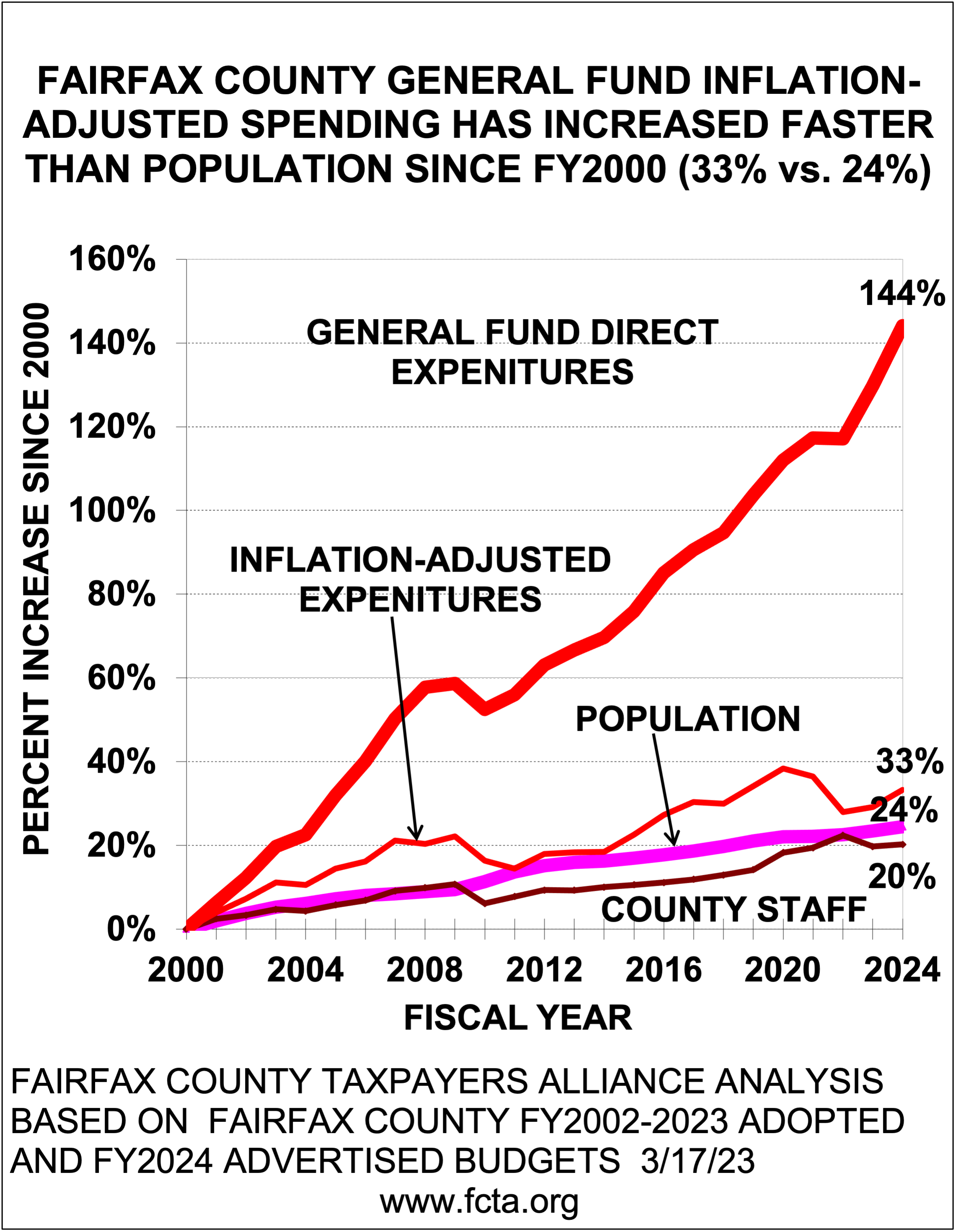

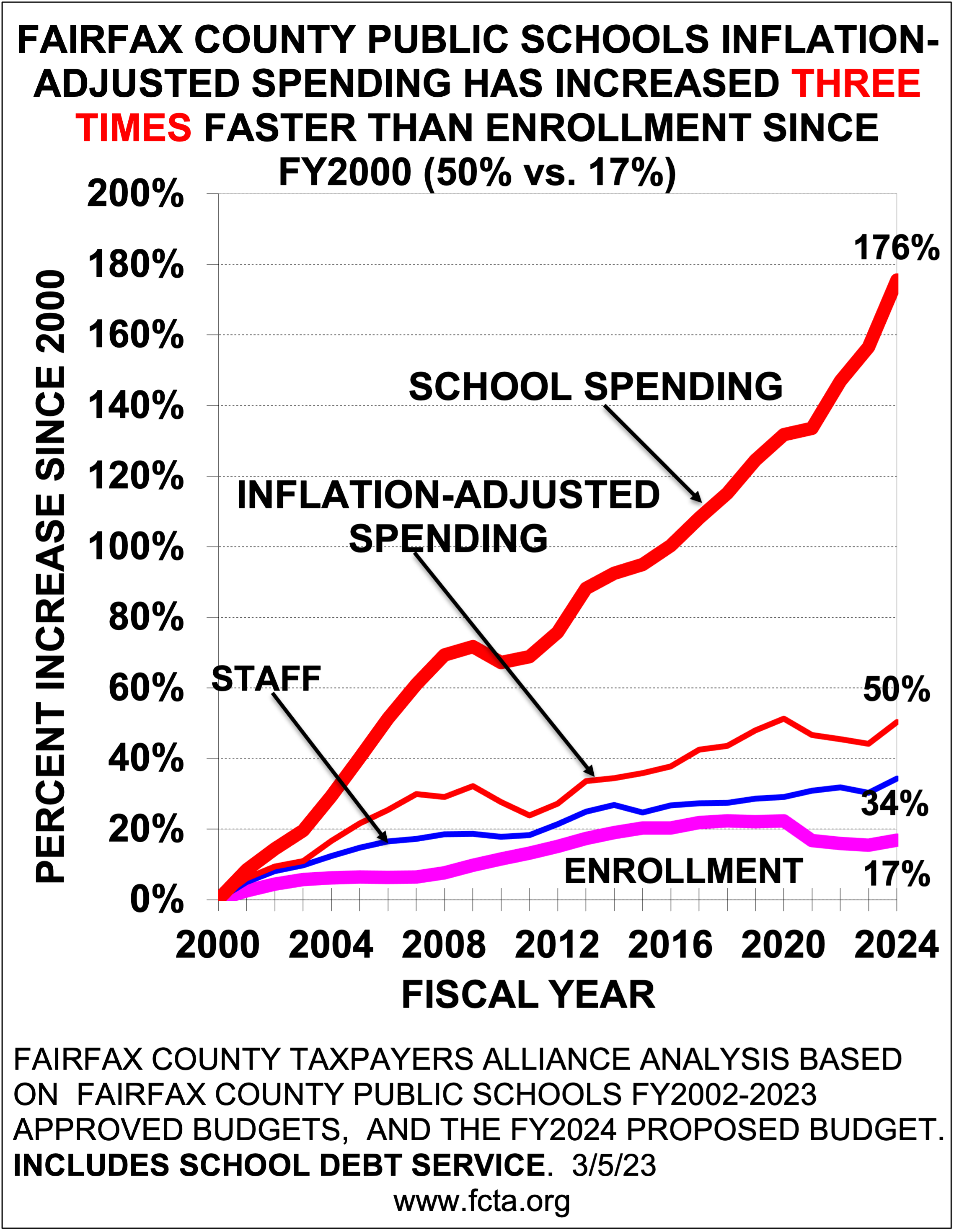

The biggest driver of increased compensation costs, by far, is pensions. The next biggest is that school staff has increased twice as fast as enrollment (34% vs. 17%). Interestingly, county staff increased somewhat less than population (20% vs 24%), for which we commend you. The other two drivers, with about equal impact, are health insurance and above-inflation raises.

Average annual inflation since FY2000 is 2.6%. Average annual raises over the same period were 3.6% for general county employees, 3.7% for sheriff's deputies, 3.9% for police, 4.3% for teachers, and 4.5% for fire and rescue.

We had expected that above-inflation raises would have been the main driver for real estate tax hikes, but it turned out that the main driver is pensions, despite reductions in pension benefits. If your employees had defined-contribution plans, as Mr. Herrity has, I believe, advocated, they could have had bigger raises, and we could have had lower taxes.

What are homeowners getting in return for paying $8,000 a year in real estate taxes instead of $4,000?

We get a county that is unaffordable, feels unsafe, and has falling SAT scores.

We get an "unaffordable housing program" in the form real estate tax hikes, and this program has no waiting list.

We got a zoning ordinance that reduces citizen input, was declared void by the Virginia Supreme Court, but is likely to be readopted by this board.

We get a police force in which the community does not have confidence, and a government in which the police do not have confidence. In 2015 the police vacancy rate was 6%; now it is 16%, and the police are working 12-hour shifts. To say that the county is the "safest" of its size is not the same as saying it is safe. Is the lack of safety a reason why the commercial portion of the real estate tax base has dropped to a 16-year low of 16%?

We get a $3 billion school system where SAT scores fell 27 points over the last five years while Virginia SAT scores increased 14 points. The last time FCPS SAT scores decreased over a five-year period was between 1989 and 1993, and the decrease was one point. The demographics of the test-takers in 2018 and 2022 are nearly identical. Montgomery County increased by 58 points. FCPS scores for Blacks, Latinos, and whites decreased by 34, 27, and 29 points.

We get an Office of Elections, whose budget has increased 70% since 2017 to handle drop boxes, unlimited absentee voting, same-day registration, and an election season instead of election day, all of which facilitates newly legalized ballot harvesting which, in turn, undermines election integrity.

To fight a overblown climate alarmism, we get a 214-page Climate Action Plan that has no cost estimates. Is this plan the real reason for the "Parking Reimagined" proposal, to cut down on parking spaces?

The Taxpayers Alliance feels that the county's deteriorating affordability, safety, and schools are not a good return on our real estate taxes.

Thank you.

Testimony from Charles McAndrew (Oak Hill) at Budget Hearing

| To: | Mr. Jeffrey McKay Chairman, Fairfax Co. Board of Supervisors 12000 Government Center Pkwy Fairfax Co. VA 22035-0071 |

| Mrs. Kathy Smith | Sully District Board Supervisor | 4900 Stonecroft Blvd | Chantilly, VA 20151-3808 |

My wife and I have been homeowners and taxpayers in Fairfax County since 1968. I am a Board Member of the Fairfax County Taxpayers Alliance. I have been protesting both the budget and real estate taxes before the Board of Supervisors for over 40 years!

- According to Chart #1, "General Funds Direct Expenditures" has increased 144% since the year 2000, while inflation-adjusted expenditures increased 33% tor this same period.

- According to Chart #2, "FCPS spending" has increased 178% since the year 2000 while inflation-adjusted spending increased 50%.

- According to Chart #3, "Real Estate Bill", the real estate tax bill increased 241% since the year 2000 while inflation increased 83% and household income increased 70% during this same period.

- According to Chart #4, "Real Estate Taxes", the Real Estate tax bill for the typical Fairfax County household (includes stormwater tax) increased from $2,401 to $8,221 since the year 2000 while inflation was 83% and household income rose 70% while the real estate bill rose over three times during that period. If it had risen at the same rate as household income had risen, it would only been $4,085.

The bottom line is that the budget including FCPS plus the real estate taxes, usually increases year after year and decade after decade at two to three times the inflation rate.

It is outrageously preposterous that most of the Board of Supervisors passed extremely generous raises for themselves! As I understand, the Board gave the Chairman an increase almost 40% over his current salary and the rest of the Board was over 30%. According to the U.S. Bureau of Labor Statistics, inflation rose 24% from the year 2015 through 2O22 during that eight-year period; that works out to an average of 3% per year. So, I could go along with the 3% pay increase each year for the eight years that the Board did not have any pay increases if they decreased the real estate taxes and gave the over-taxed homeowners reduction in their real estate taxes! I thank Supervisor Herrity and Supervisor Alcorn for voting against this large pay increase!

It is time for the Office of Management and Budget and/or the Chief Financial Officer to carefully review the overall budget including the FCPS budget. with a budget of over SS Uitlion in General Funds, $3.3 billion in FCPS, and a grand total of $13.5 billion, including Fiduciary Funds. It is time for implementing Zero-Based Budgeting -- a method of budgeting in which all expenses must be justified for each new period. This process starts from a "zero base" and every function within an organization is analyzed for its needs and costs. The county staff should review every program to determine any redundancy or obsolete programs and cut the budget wherever they can.

I look forward to a written response to my presentation. Thank you for your attention.

Charles McAndrew

|

Testimony from Tom Cranmer (Great Falls) at Budget Hearing

TO: the Fairfax County Board of Supervisors:

Thank you for the opportunity to speak to you about issues relating to the proposed budget and the management of the County.

Pew Research reports 80% of people do not trust governments. After the major bungling of the Covid crisis by governments, reasonable people doubt anything governments or medical doctors say now. I previously pointed out to Fairfax Supervisors the idiotic decrees and ignoring of knowledgeable scientists.

The taxes you proposed are unreasonable. Real estate taxes are a huge burden for the residents of Fairfax. House prices are supposedly going up as the basis for real estate taxes. This is an unrealized gain that may disappear. Many people do NOT have the cash or credit to cover the real estate taxes you are imposing, food for their families, money for gasoline, resources to pay their mortgages and other loans, and normal living expenses. Nearly half the country is living paycheck to paycheck. They don't have cash to pay for emergency expenses. Credit card interest is running 20-30%. Don't any of you remember the economic disaster under Jimmy Carter?

Inflation under Biden:

- All Items 14.4%

- Gasoline 35.2%

- Utilities 41.5%

- Groceries 19.7%

This Bidenflation has eaten away people's resources. It has been caused by too much printed money available to buy too few goods. The stock and bond market have also dropped by about 20% on average. I previously warned you about Stagflation.

Potential for 200 significant bank failures. A major paper by top economists presented their findings about the financial weaknesses of 200 banks. The first big disasters were Silicon Valley Bank, Republic Bank and Credit Swiss. The US Federal Deposit Insurance Agency did not have enough reserves to cover all the deposits of the first two banks, and the US taxpayers will have to cover the shortfalls. The excess coverage is illegal and not authorized by Congress. The depositors ignored the fact their deposits were far greater than the level covered by the FDIC insurance. They apparently believed, correctly, that their political Democrat friends in the US government would bail them out. Their belief was correct.

Crime is also a major problem. The major cities have record levels of all types of crime. People are afraid to carry on business in the cities or even go there. The Fairfax Police Department does not even report detailed levels of crime that occurred since 2020. Police staffing is down 15.7% according to your report (239 positions). Criminal arrests were 18,187 in CY 2022 and you project they will rise to 26,748 this year. Why do the police need a Woke supervisor? How does this help fight crime or increase police officers? Why do we have to depend on neighbors reporting crime to us instead of police reporting?

Schools are dangerous. During my previous testimony you said the BOS has no responsibility for schools. Schools are 52% of your budget, so you should be responsible. There is no inspector general for the schools with responsibility for analyzing why school attendance has dropped significantly. The BOS apparently has done nothing to identify problems. There is no analysis of the lack of discipline in schools.

Information on shootings and lawlessness in schools is lacking. We are not even allowed to receive a copy of the review of rapes in Loudoun County, or the manifesto by a murderer at the Coventry School where three kids and three teachers were killed recently.

There is no inspector general to analyze the BOS actions. Internal audits are done, but they are narrowly focused on paperwork, not overall deficiencies of the BOS.

Your support for the Metro is absurd. Those few riders who are brave enough to ride the Metro are not enough to provide significant financial support. Murders, shootings, and robberies (if reported) seem frequent. Very few people want to ride the Silver Line, and the construction overruns have been large. People are jumping the turnstiles without worry of arrest. Fairfax County's guarantees of Metro bonds seem to be foolish.

Potential for War: Many commentators are discussing the possibility of a major war. I am one of them and have published a paper about this in the American Center for Democracy. I suggest you consider the role of the BOS management and who might lead efforts to prepare and deal with damage from war. The police, fire departments and hospitals will be inadequate. I previously distributed a booklet about how individual families might prepare for an emergency.