From: Charles McAndrew / 12808 Willow Glen Ct / Oak Hill, VA 20171

Presentation to the Fairfax County Board of Supervisors on the County Budget - 04/11/2019

| To:† | Mrs. Sharon Bulova Chairman, Fairfax Co. Board of Supervisors |

| Mrs. Kathy Smith | Fairfax County | Board of Supervisor |

| Ms. Karen Corbett Sanders | Chairman | FCPS Board |

| Mr. Tom Wilson | Member | FCPS Board |

|

|

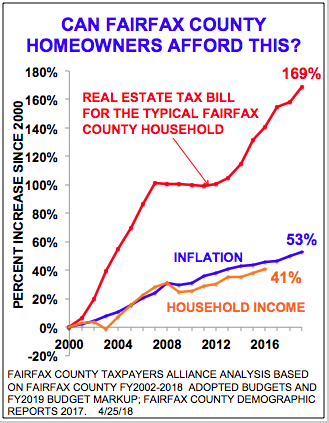

My wife and I have been homeowners and taxpayers in Fairfax County for more than 50 years! I am here to protest the budget and real estate tax increases! The FY 2020 General Fund Disbursements are projected to be $4.437 billion, an increase of 3.67% over the FY 2019 Revised Budget Plan and represents $156.95 million. The Fairfax County Public Schools (FCPS) total budget is $3.0 billion, an increase of 4.1% over last year's budget and represents $117.4 million. The General Funds Transfer to the FCPS reflects <>an increase of $86.46 million or 4.11% over the funding level of the FY19 Adopted Budget. While Real Estate Tax rate remained the same as last year's at $1.15 per $100 of assessed value, it is estimated that the average tax bill will approximately increase of $150. According to the Fairfax County Taxpayers Alliance, for the past 20 years, real estate taxes for the typical homeowner have increased three times faster than household income. My wife and I saw our home increase 4.24% in assessed value for tax purposes for this year. Isnít it time to give all retired taxpayers a break in real estate taxes and reduce the budget?

I have been appearing before this Board for more than the past four decades testifying on the annual budget and real estate taxes, and I can honestly state that the County and the FCPS budget increases year after year and decade after decade at least two or three times the Consumer Price Index (inflation rate)! The nationwide Consumer Price Index, according to the Department of Labor, Bureau of Labor Statistics states that for calendar year 2018, the rate increased 1.6%. I have been told that the Washington, Arlington, and Alexandria consumer price index increased overall to an average of 1.9%. I have noticed a pattern in the board's decision on raising the budget and taxes. Every four years, in an election, the Board does not raise the budget and taxes near as much as the other three years. So for this year, it is on the leaner side. Look out for next year!

A couple of years ago, I recommended the County set up the Office of Inspector General (OIG). I understand that the county and the FCPS have a few auditors on their staffs. I have noted that Montgomery County and D.C. Governments do have the OIG. The mission of the OIG is to conduct independent audits, investigations, inspections and evaluations to promote economy, efficiency, and accountability to prevent and detect waste, fraud, abuse, and mismanagement in the programs and operations of an organization. This is an independent office that strives to maintain the highest level of trust, integrity, and professionalism. The investigators have the authority to prosecute individuals for fraud. The IG would report to the Chairman of the County Board and for the FCPS, the Chairman of the FCPS School Board. In my experience in the financial management area of the Federal Government, the OIG has paid for itself through their findings and recommendations. I recommend that the County along with the FCPS implement the OIG.

It is time to raise the pension age to 62 for newly hired employees. Last, but not least, it is time for the Board to address the unfunded pension liabilities of $2.84 billion for Fairfax County and $3.46 billion for FCPS totaling $5.3 BILLION!

I look forward to a written response to my presentation. Thank you for your attention.

Charles McAndrew

FCTA Board member

Chairman Bulova's Response - 06/21/2019

Dear Mr. McAndrew:

Thank you for your presentation during the FY 2020 Budget Public Hearings and your continued engagement with the Fairfax county budget process. As you referenced, the FY2020 real estate tax rate would remain consistent with the FY2019 tax rate at $1.15 per $100 assessed property. In addition, County Executive Hill has identified over $3.6 million in cost savings from operational efficiencies.

The Office of Financial and Program Auditor (OFPA) provides an independent means for determining the manner in which policies, programs, and resources are authorized by the Board of Supervisors. It serves a similar function as referenced in your budget presentation. The information is guided through the Board of Supervisors audit committee. The School Board has similar audit capabilities as well.

At the conclusion of the FY2018 budget proceedings, the Board of Supervisors directed the County Executive to reexamine our employee retirement packages. The Board will examine plan provisions and benefits such as increasing the minimum retirement age, Rule of 85, Deferred Retirement Option Program (DROP), and pre-Social Security supplement. A work group was convened of stakeholders including employee groups, budget staff, community members, and others to evaluate these proposals for a submission to the full Board of Supervisors.

A set of recommendations was approved by the Board of Supervisors at the December 12 Board of Supervisors meeting. The recommendations included elimination of pre-social security supplement, rolling back a 3 percent increase of the county retirement systems' calculated retirement annuity, and other housecleaning items for the retirement system. These changes would take effect for employees hired on or after July 1, 2019. These changes would reduce overall costs while ensuring the retirement system will remain stable in the future years. The Board of Supervisors will continue to look for opportunities to streamline and find other cost savings within our systems to improve our operations. Thank you for writing again.

Sincerely,

Sharon Bulova

Chairman