FCTA Response to Fairfax Co FY2019 Budget Markup

by Arthur Purves, April 25, 2018

|

|

In her 4/24/18 Bulova Byline, County Chairman Sharon Bulova's statements on the proposed FY2019 real estate tax increase are misleading. Her proposed FY2019 rate of $1.15 per $100 of assessed value omits the stormwater rate. When the stormwater rate is included the proposed FY2019 rate is actually $1.1825.

She states that new budget includes a 2-cent increase in the real estate tax rate, but this omits the additional tax increase due to the 2.2% increase in average residential assessments. The effective rate increase when assessments and the additional stormwater rate increase (1/4 cent) are included is 4.7 cents, not 2 cents.

The typical Fairfax County homeowner's real estate tax bill will increase by $258, a 4.2% increase, while Loudoun County cut its real estate tax rate by 4 cents, reducing the average tax bill by $48, a 1% decrease.

Meanwhile, the Bureau of Labor Statistics reports that the average paycheck of people employed in Fairfax County declined by 0.6% between September 2016 and September 2017.

Chairman Bulova states that the tax hike fully funds the Market Rate Adjustment, Performance, Merit and Longevity increases for county employees and states that the Market Rate Adjustment is 2.25%. She does not state the total salary increase resulting from the Performance, Merit and Longevity increases. When those are included, county employees will see average increases ranging from 4.25 to 4.50 percent.

Likewise, the school board is funding 2.3% step increases and other salary adjustments, but does not say what the total average raise will be when the other adjustments are included.

Most of the real estate tax hike is to pay for 4% raises. The McLean Citizens Association urged the supervisors to increase salaries by approximately the rate of inflation, which is projected to be 2.3%.

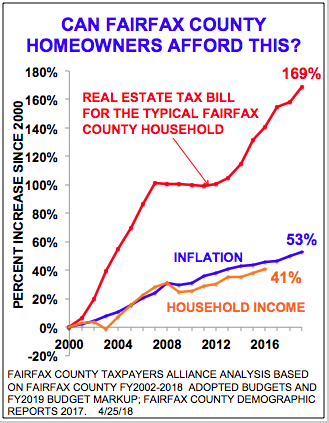

Since FY2000, the supervisors have increased real estate taxes 169%, more than three times faster than inflation, which increased 53%. This is a hardship for the county's retirees.

Last year, Fairfax County had 15,350 more residents move away to other parts of the region or the U.S., than people who moved into the county from other U.S. localities. The proposed FY2019 budget will drive away even more residents, as is happening in New Jersey, Illinois, and New York.

If the (Democrat-dominated) Board of Supervisors felt that the tax increases were justified, they would not have resorted to the half-truths in the Bulova Byline. FCTA rejects taxation by misrepresentation.