From: Charles & Linda McAndrew / 12808 Willow Glen Ct / Oak Hill, VA 20171

| To:† | Mrs. Sharon Bulova Chairman, Fairfax County Board of Supervisors Fairfax County Government 12000 Govt Center Pkwy Fairfax, VA 22035 |

Mrs. Kathy Smith Fairfax County Board Supervisor Sully District Government Center 4900 Stonecroft Blvd Chantilly, VA 20151 |

Dear Mrs. Bulova and Mrs. Smith:

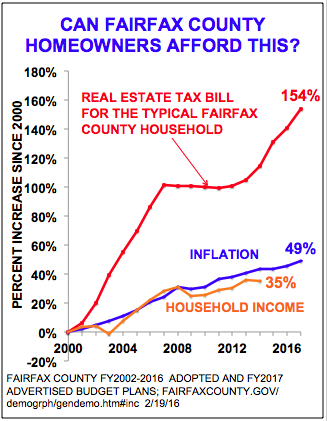

We want to protest the increase in the projected total rate of $1.1585. We believe that this projected rate should be no more than the inflation rate. We have had increases in our real estate taxes that have more than doubled the inflation rate for the last eight years as noted on the chart below.

|

|

YEAR ASSESSMT TAX RATE TAXES PD PCT INCR 2016 $698,120 *$1.1585** $8,088** +3.7% 2015 $698,120 *$1.1135 $7,774 +3.99% 2014 $671,360 *$1.1135 $7,476 +8.4% 2013 $623,510 *$1.1060 $6,896 +4.4% 2012 $602,700 *$1.0960 $6,606 +7.2% 2011 $567,580 *$1.0860 $6,163 +3.9% 2010 $536,150 *$1.1060 $5,930 +1.2% 2009 $568,950 *$1.0510 $5,923 +2.97%

In the eight years, as you can see by this chart, our real taxes have increased from $5,923 to a projected $8,088 for 2016 for a whopping 27% increase! For the same period of time, inflation increased 10.7% as reported by the U.S. Bureau of Labor Statistics for Fairfax County. Their figures show an estimated 1.0% for 2016, as +0.1% for 2015, +1.6% for 2014, +1.5% for 2013, +2.1% for 2012, +3.2% for 2011, +1.6% for 2010, and -0.4% in 2009. These statistics show that our real estate taxes have increased twice the inflation rate for that eight year period. This is outrageous! Our current assessment is projected to increase by 3.7% while the inflation rate is projected to increase by 1.0% for 2016, as estimated by Kiplinger's magazine. How can you really justify increasing real estate taxes more than three times the rate of inflation? For decades, the County Board has been raising the budget and taxes more than two to three times the inflation rate! Isnít it time to give the county taxpayers a break? Is it your goal to run retired and middle class taxpayers out of Fairfax County?

According to the Fairfax County Taxpayers Alliance (FCTA), the residential real estate taxes increased from $2,400 to $6,100 between FY2000 and FY2017. This simply means that, during this period, according to the U.S. Bureau of Labor Statistics, inflation increased almost 49% during this 17-year period while the residential real estate, according to FCTA, increased 154% or more than three times faster than household income and the inflation rate. How can you really justify increasing real estate taxes more than three times the rate of inflation? For decades, the County Board has been raising the budget and taxes more than two to three times the inflation rate! Is it your goal to run retired and middle class taxpayers out of Fairfax County?

In conclusion, we feel that the real estate tax rate should be rolled back to the current rate of inflation. We look forward to your comments. Thank you for your attention.

* † Includes storm water tax and infestation prevention tax.

** Projected based on the latest proposed tax rate increase for 2016.Sincerely,

Charles McAndrew and Linda McAndrew