From: Charles & Linda McAndrew / 12808 Willow Glen Ct / Oak Hill, VA 20171

| To: | Mrs. Sharon Bulova Chairman, Fairfax County Board of Supervisors Fairfax County Government 12000 Govt Center Pkwy Fairfax, VA 22035 |

Mr. Michael Frey Fairfax County Board Supervisor Sully District Government Center 4900 Stonecroft Blvd Chantilly, VA 20151 |

Dear Mrs. Bulova and Mr. Frey:

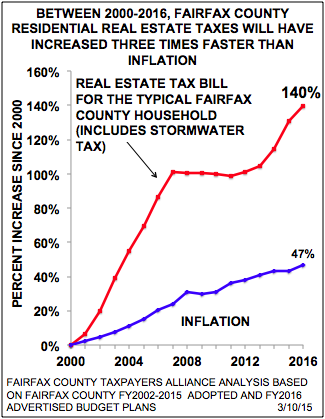

We want to protest the increase in the projected total rate of $1.1135. We believe that this projected rate should be no more than the inflation rate. We have had increases in our real estate taxes that have more than doubled the inflation rate for the last eight years as noted on the chart below.

|

|

YEAR ASSESSMT TAX RATE TAXES PD PCT INCR INFL'N 2015 $698,120 *$1.1135** $7,774** +3.99% +2.0% 2014 $671,360 *$1.1135 $7,476 +8.4% +1.6% 2013 $623,510 *$1.1060 $6,896 +4.4% +1.5% 2012 $602,700 *$1.0960 $6,606 +7.2% +2.1% 2011 $567,580 *$1.0860 $6,163 +3.9% +3.2% 2010 $536,150 *$1.1060 $5,930 +1.2% +1.6% 2009 $568,950 *$1.0510 $5,923 +2.97% -0.4% 2008 $624,530 *$1.0410 $5,752 +3.8%

In the eight years, as you can see by this chart, our real taxes have increased from $5,752 to a projected $7,774 for 2015 for a whopping 32.0% increase! For the same period of time, inflation increased 15.4% as reported by the U.S. Bureau of Labor Statistics. Their figures show a projected rate as +2.0% for 2015, +1.6% for 2014, +1.5% for 2013, +2.1% for 2012, +3.2% for 2011, +1.6% for 2010, -0.4% in 2009, and +3.8% in 2008. These statistics show that our real estate taxes have increased twice the inflation rate for that eight year period. This is outrageous! Our current assessment is projected to increase by 3.99% while the inflation rate is projected to increase by 2.0% for this year.

According to the Fairfax County Taxpayers Alliance (FCTA), the residential real estate taxes increased $3,359 between FY2000 and FY2016. This simply means that, during this period, according to the U.S. Bureau of Labor Statistics, inflation increased almost 40% during this sixteen year period while the residential real estate increased 140% or more than three times the inflation rate. How can you really justify increasing real estate taxes more than three times the rate of inflation? For decades, the County Board has been raising the budget and taxes more than two to three times the inflation rate! Isn't it time to give the county taxpayers a break?

In conclusion, we feel that the real estate tax rate should be rolled back to the current rate of inflation. We look forward to your comments. Thank you for your attention.

* Includes storm water tax and infestation prevention tax.

** Projected based on the latest proposed tax rate increase for 2015.Sincerely,

Charles McAndrew and Linda McAndrew